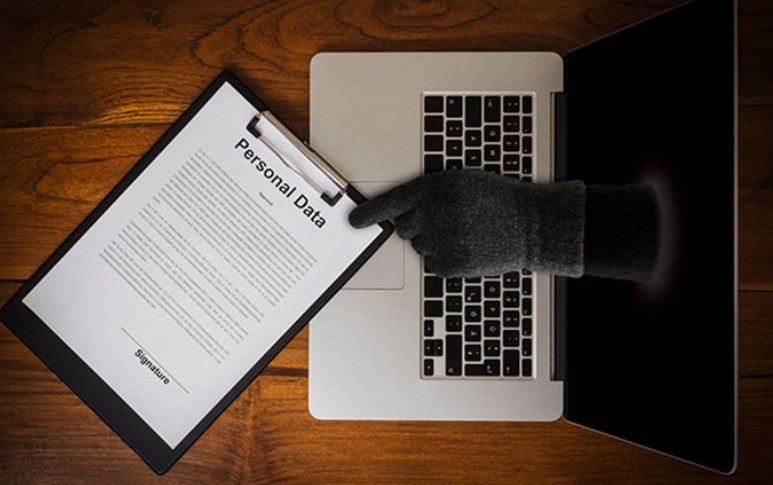

Identity theft is on the rise and may harm everyone. Thankfully, an ever-growing number of identity theft protection services are available to assist you in better protecting your identity. These services can contain a mix of identity monitoring, credit reports, identity retrieval, and identity theft insurance, with prices varying according to the features. Identity theft happens when a person or a criminal organization steals a person’s identifying information and uses it to conduct fraud. Names, social security numbers, birthdays, residences, bank account information, and other personal information may be included. Criminals then utilize this information to open financial accounts in the victim’s name, steal retirement benefits, buy real estate, and do other things.

Points To Consider While Choosing An Identity Theft Protection Solution

List of Contents

There are THREE Credit Bureaus to Consider

Experian, TransUnion, and Equifax are the three independent credit bureaus in the United States. Each bureau provides routinely updated credit reports and scores, albeit the material varies slightly. If you’re looking for identity theft protection, be sure it covers all three bureaus. You can discover all potential problems if you have real-time access to your credit reports.

Benefit From The Free Trials

Identity theft protection service providers are competing for your business. As a result, each gives new clients free trials. Use these trials to compare apps and figure out which features are most important to you. Premium features raise the cost, and you don’t want to pay for something you’re not going to utilize. Cancel your free trials before the end date to avoid paying a monthly cost.

Look Out For Discounts

Yes, all most prevalent identity theft protection programs come with discounts. These discounts could include using an online promotion coupon or purchasing a yearly subscription.

Surprisingly, you may already have a free identity theft protection package and are unaware of it. Additionally, some banks and credit unions now provide free identity theft protection as part of their membership. Credit card firms are increasingly doing the same thing. Some firms that offer identity theft protection plans only give minimal packages. If certain features are missing, you may need to upgrade to a premium subscription.

Individual or Family Plans?

Unfortunately, you aren’t the only one in your family who needs to be concerned about identity theft. Scammers frequently target children because they do not yet have a credit history. This makes it easier for crooks to register new accounts in their names in some situations. A family identity theft protection plan may be a better option than individual coverage in your scenario. And the cost difference could be negligible.

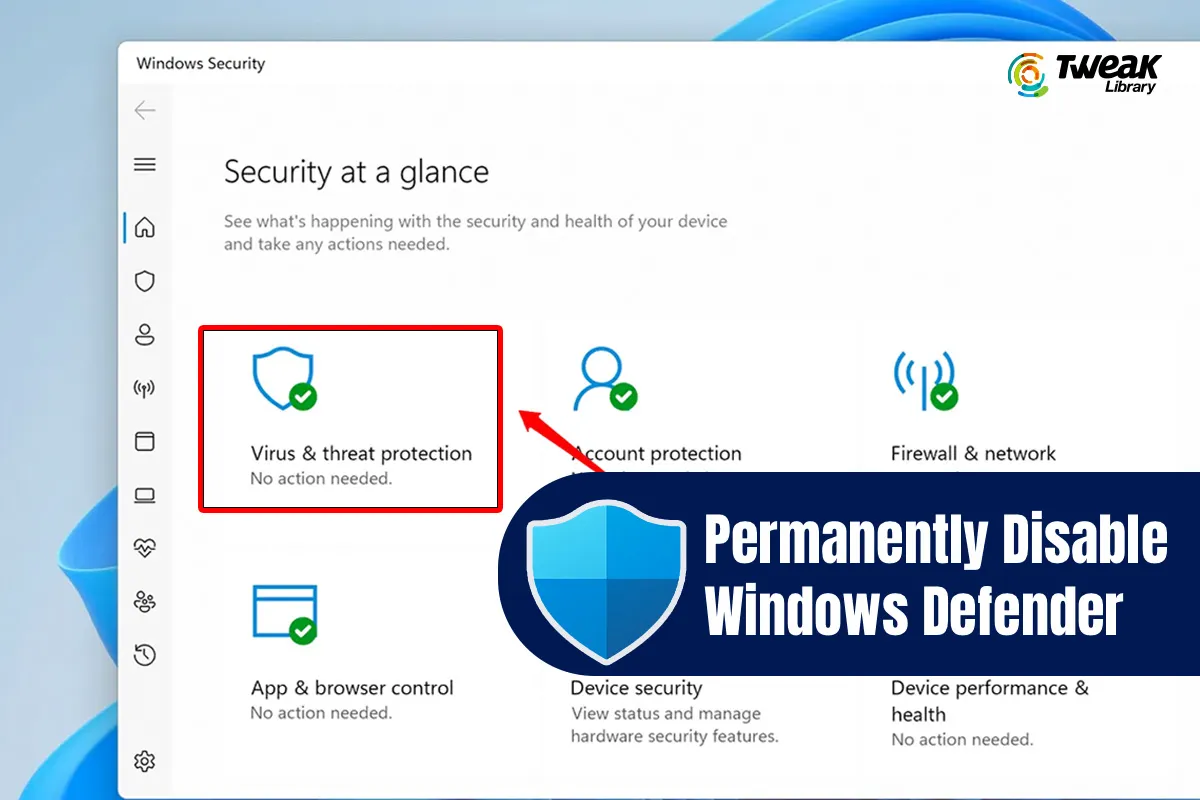

Bonus Tip: Use Advanced Identity Protector

Choosing a solution for Identity theft Protection is not an easy task but we have highlighted one such app – Advanced Identity Protector, that will take care of all your privacy needs. This app makes sure that your personal information traces like credit card details, emails, passwords, and social security details remain a secret on your PC and can be used only by you. Once the software scans your PC it will highlight traces of sensitive personal information and provide the user with an option to either remove them permanently or save them in a secure digital vault.

- Safeguard Personal Information

- Protect Credit Card Information

- Organizing Personal Data Securely

- Quickly access a variety of data

Download Advanced Identity Protector

Your Thoughts On How Do You Select The Appropriate Identity Theft Protection Solution For You And Your Family?

There’s a lot you can do to prevent identity theft, and there are clear recovery processes to follow if it does happen. Apart from the yearly or monthly fee of identity theft protection, once it’s established that something illicit has occurred, identity theft will not cost you any money out of pocket. The highest cost is not monetary but rather the time and effort required to clear your name of errors. As a result, adding identity theft insurance to your plan isn’t necessary.

Please let us know of any queries or suggestions in the comments section below. We would love to get back to you with a solution. We regularly post tips and tricks and answers to common issues related to technology.

Leave a Reply