The best accounting software is the one that simplifies the task of maintaining comprehensive financial records, ensuring readiness for tax season. It also features tools for analyzing the financial health of your company and automating various accounting processes, including invoicing.

Selecting the best accounting software for your small business in 2025 will enhance your bookkeeping procedures, ensure accuracy in your financial reports, and reduce the risk of costly errors.

Online accounting software, designed for team collaboration, process mechanization, and financial management in enterprises, operates in the cloud. This means that anybody with an Internet connection can access it anytime and from anywhere.

Our Top 5 Accounting Software for 2025

Get Ahead of the Game with These Top Accounting Software and Maximize your Profits.

List of Contents

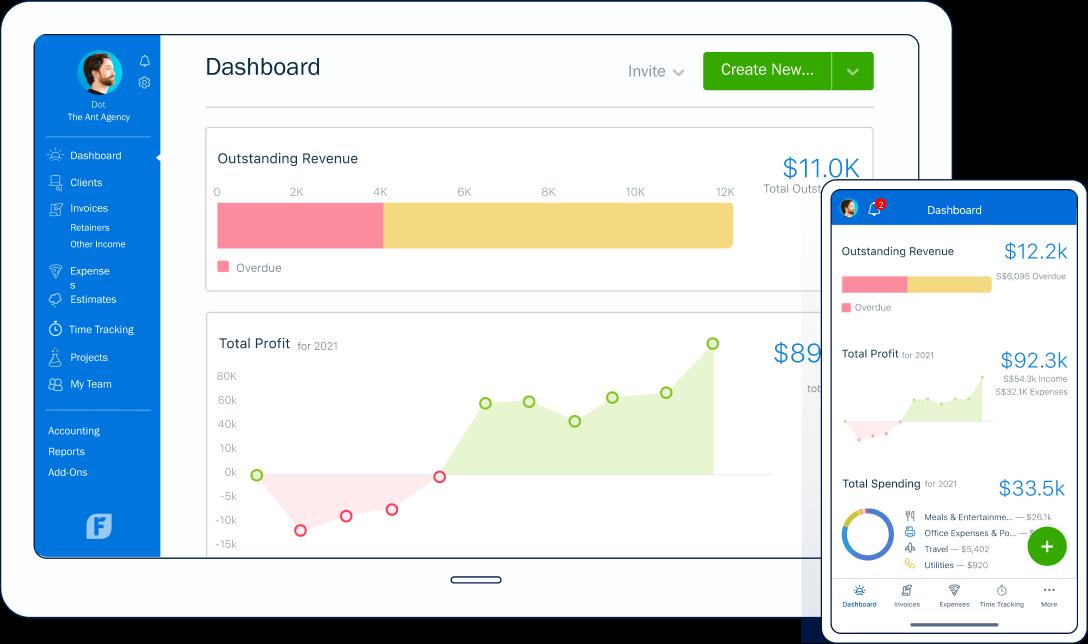

1. FreshBooks

Sending, receiving, printing, and paying invoices are done through FreshBooks. Its main purpose is to take care of a company’s standard bookkeeping requirements. FreshBooks ispicked due to its proficiency in submitting proposals, monitoring project time, and collecting payments—all essential functions for firms that provide services.

For free contractors and small enterprises, FreshBooks is an online accounting program that has gained awards and makes bookkeeping simple and enjoyable. You may work with clients, monitor time, get payments, manage costs, and more with it. You can also produce professional invoices.

Features

- Allows auto-sending invoices and regular profiles for the same trade

- To stay on top of payments, set up customizable, automatic reminders

- Permits employees and outside contractors to work on the same project

- Online payments and bank connections guarantee that users get paid on schedule

- Rapidly generates information to assist business owners in planning

- Quickly respond to customers using its mobile app

- Cloud-based

- Interface that is easy to use

- Sophisticated features for invoicing

- Integration of Third-party apps

- Reasonably priced

- The mobile app does not have reporting functions

- Extra users come at an additional expense

Price: Starts at $17 per month

Also Read: FreshBooks: A Review on The Best Cloud Accounting Software

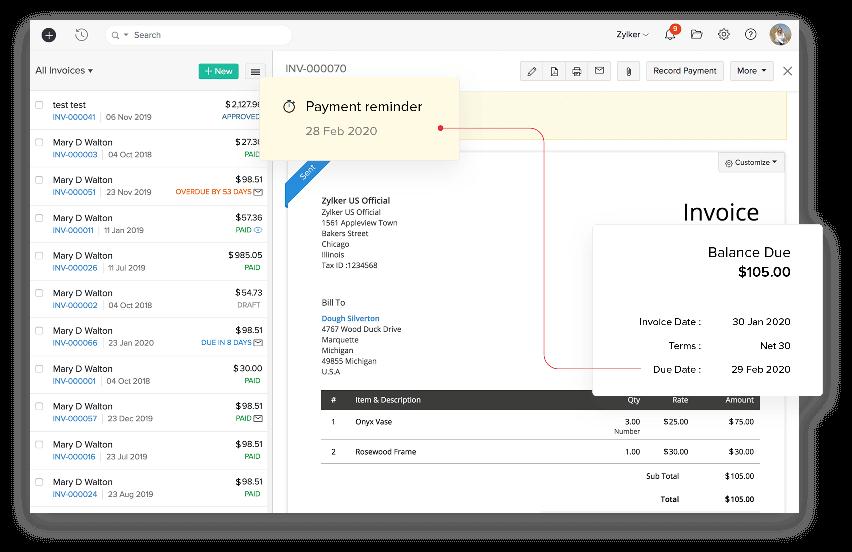

2. Zoho Books

A feature-rich online accounting program designed for small and medium-sized enterprises is called Zoho Books. You can use it to handle your contacts, projects, income, costs, taxes, and inventory, and more. Furthermore, it integrates seamlessly with other Zoho products and external programs like Shopify, PayPal, etc.

With Zoho Books, you can keep track of your spending, generate reports, join accounts, and issue invoices—all of the capabilities you need to manage your money. If you require them, it also offers more sophisticated functions like time monitoring and project accounting.

Features

- The sample version is also interactive

- Access that allows vendors or contractors to view critical data

- Creates unique bank rules and tags to make transaction organization simple

- Informs users when supplies run low and automatically sends purchase orders

- Use its smartphone app to manage chores and receive real-time information

- Creates invoices quickly, requiring users to only review the details

- A free plan is available

- Take both online and physical payments

- Reasonable paid subscriptions with a monthly maximum of 5,000 invoices

- Keep a record of your spending and travel

- Connects to further Zoho apps

- Payroll pays additional expenses

- There is a cap of 1,000 invoices per year for the free plan

Price: Starts at $14 per user per month

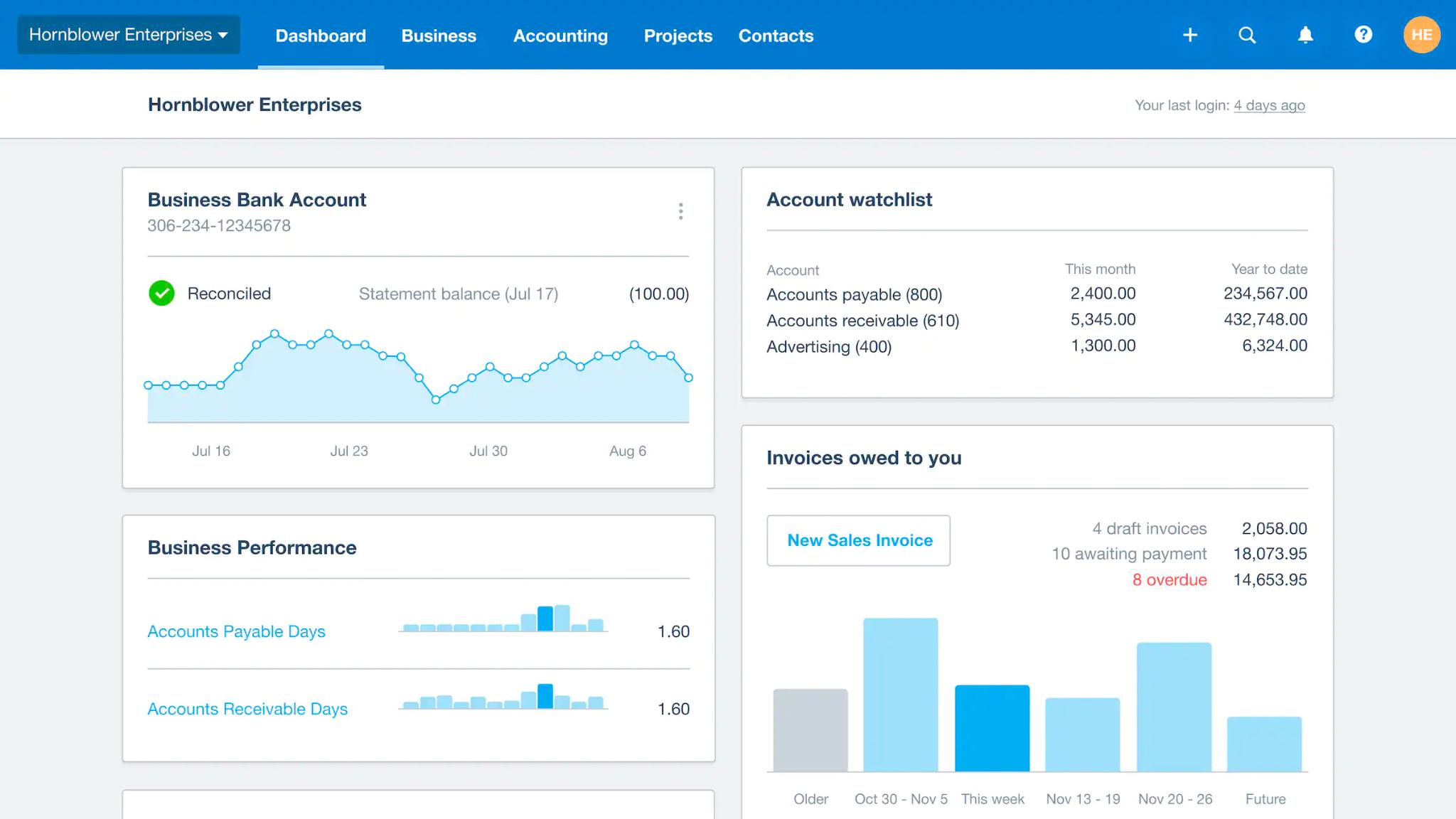

3. Xero

With over 2 million users globally, Xero is an online accounting software that runs on the cloud. Its strong feature set helps in both financial management and business expansion. It’s simple to make invoices, keep track of bills, balance bank accounts, compute taxes, produce reports, and more. Additionally, Xero can be integrated with more than 800 services and apps that you use for your company. It’s as low as free accounting software for Windows.

All thanks to its trend analysis and customizable reporting systems, users can make confident business decisions. It even offers a 30-day free trial, after which you can choose from three pricing plans that covers the accounting essentials, with room to grow.

Features

- Make recurring payments in bulk to stay organized

- Allows for the tracking of cost claims on a real-time basis

- Creates straightforward yet insightful reports to monitor business expansion

- In its mobile app, you may access and track distance at any time, anywhere

- Imports bank data from a year ago seamlessly for quicker transactions

- Makes invoices straight to save time

- Cloud-based

- Holds a mobile app

- Satisfaction payroll integration

- Marketplace for third-party apps

- Basic inventory control

- Limited reporting

- Charges associated with ACH payments

- Poor client support

Price: Starts at $11.00 per month

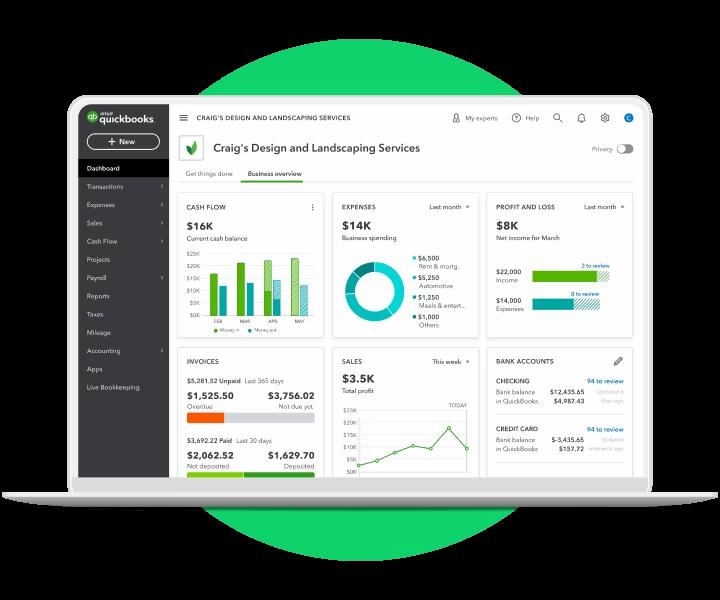

4. QuickBooks Online

One of the most widely used accounting programs for successfully managing your finances and running your company is QuickBooks Online. In addition to managing cash flow and creating invoices, it also allows you to prepare taxes. Moreover, it integrates with more than 650 platforms and apps.

This makes it a comprehensive and customizable solution for efficient bookkeeping and financial analysis. So, whether you need an accounting software for your small business or an enterprise, QuickBooks Online a top-notch solution for you to simplify and optimize your accounting processes without putting in much effort.

Features

- Monitor your earnings and outlays

- Keep track of spending for tax season

- Generate personalized, expert sales receipts, estimates, and invoices

- Manage your company from the cloud

- Several customizable reports

- Outstanding timekeeping and inventory control

- Complete contact information and transaction forms

- Supports several add-ons, payroll, and projects

- Fantastic mobile applications

- Costly

Price: Starts at just $15 per month

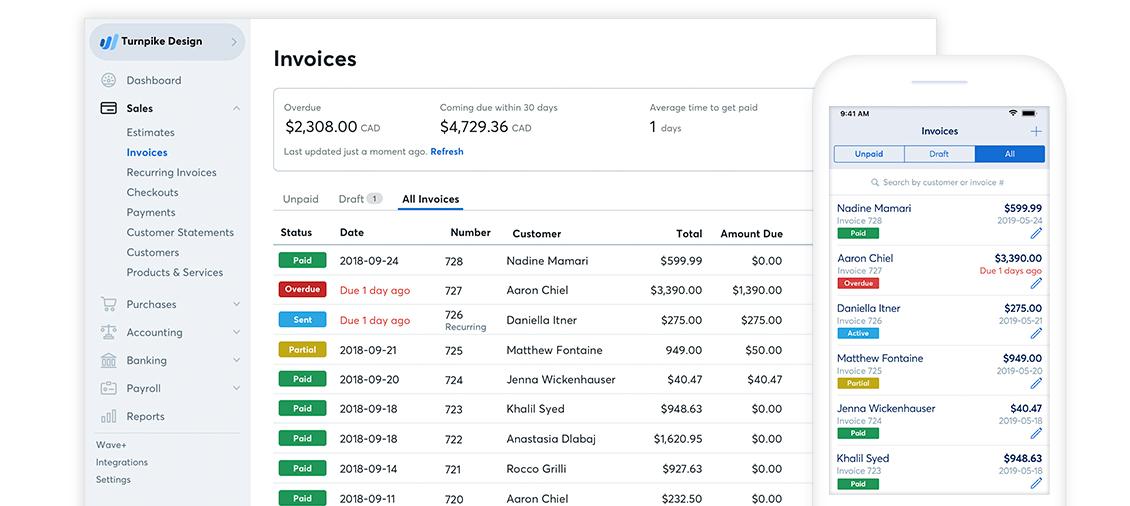

5. Wave Accounting

With Wave Accounting, you can easily manage your accounts with free online accounting software. This free online accounting software is excellent for small firms and sole entrepreneurs. You may track revenue and spending, make and send invoices, scan receipts, and produce reports with the program. Payroll is another tool offered by Wave Accounting but at an extra cost.

The best part is, that Wave Accounting offers seamless integration with a variety of payment processors. Hence, simplifying online transactions. One of Wave’s standout features is its free accounting and invoicing tools, making it an attractive option for budget-conscious users.

Features

- Personalized invoices are highlighted with your company’s logo

- Manage the account rights with an infinite number of collaborators

- Organize cash spending and revenue reporting on an infinite number of bank accounts

- Follow up on correspondence with every client by looking through their details

- Produces rapid annual and monthly reports on a mobile device

- Free billing and bookkeeping

- There are no restrictions on transactions or billing

- Manage several companies with a single account

- An infinite quantity of users

- Available on mobile

- Integrations via Zapier alone

- Increased costs while using a credit card

- There are just 14 states that offer full-service payroll

- Scanning receipts is $8 per month

Price: Starts at $30 per month

Conclusion

Choosing the best accounting software is essential for businesses aiming to thrive in the fast-paced finance sector. However, if you want customized solutions, you might consider collaborating with a software development business. They can craft accounting software, particularly for your needs, ultimately maximizing your financial performance and ensuring long-term success.

Did we miss any good Accounting Software that should be a part of this list? If yes, feel free to mention them in the comments section below!

Next Read:

Leave a Reply