U.S. law defines identity theft as the misuse or attempted misuse of any identifying information, such as social security number, biometric data, and credit card number, to commit fraud. Law enforcement authorities acknowledge that identity thieves are increasingly more sophisticated in their quest to gain unauthorized access to personal information to feed their illegal activities. Data theft can occur online or offline. This article discusses five features associated with identity theft and suggests ways to minimize your risk.

1. Where you live

According to a report published by the FTC, five states with the highest per capita incidence of identity theft complaints are Arizona, California, Florida, Nevada, and Texas. In each of these states, the most common types of identity theft involve employment-related fraud, credit card fraud, phone or utilities fraud, and government documents or benefits fraud.

Must Read : Safeguard Against Identity Theft

2. How old you are

People of all ages are at risk of identity theft. However, FTC data for the 2006-2008 period show the people most likely to be victimized are 20-29-year-olds. This group accounts almost 25% of reported cases of theft of personal information, nationwide.

3. Where you shop

The use of the Internet exposes all of us to the threat of identity theft. Ironically, there is a growing trend urging us to go paperless for practically all transactions, including consumer purchases, medical information, banking services, credit card billing, payment for utilities, and more. This explains why the most harmful types of identity theft involve new credit card and non-credit card accounts.

4. Where you work

Several cases of data breaches in recent times have been inside jobs involving disgruntled employees who abuse their privileged access to compromise clients’ personal information. These employees are also likely to succumb to accepting bribes in exchange for granting thieves unauthorized access to privileged records. While certain industry sectors, such as those providing financial services are more susceptible, recession-induced massive layoffs spreads the vulnerability across the economy.

5. Your offline habits

Identity thieves are predators, who will go to any length to steal your private information. They are good at dumpster diving, meaning they rummage through your household trash or public trash dumps to feed their need for sensitive personal information. When you dump your old bank statements, unused credit card offers, and ATM receipts, you create opportunities for data thieves.

Tips on How to Protect Yourself

Various surveys show that victims don’t always know the persons who stole their personal information. This makes it difficult to protect yourself adequately against an unknown enemy. However, the following tips can help make it harder for thieves to gain access to our private information:

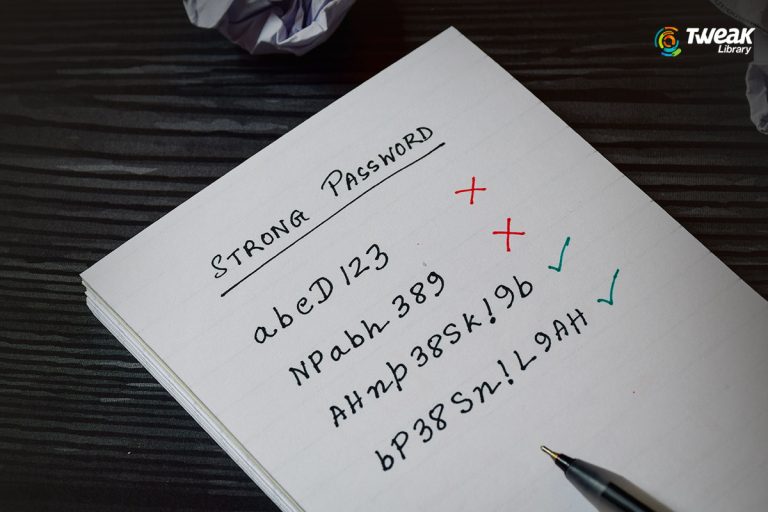

- Keep your personal documents in a secure place. Offline, this means using storage devices with locks. Online, using regularly updated virus protection software, firewall program, secure browser, and strong passwords, will help limit unauthorized access.

- Take advantage of the Federal law, which gives every consumer the right to one free credit report from each nationwide consumer reporting company every 12 months. The FTC suggests that staggering these reports – that is, getting a report from a different company every few months – can help you monitor activity on your credit reports.

- The threat posed by identity theft has given rise to many companies that advertise products or services to help consumers prevent or minimize their risk of identity theft. The FTC recommends that before you pay for any data theft prevention product or service, to make sure you understand exactly what you’re paying for.

- If you suspect you have been, or are about to be, a victim of identity theft you may ask a consumer reporting company to place an initial fraud alert on your credit report. An initial fraud alert is good for 90 days, and renewable when appropriate. If in case your identity has been stolen, you can ask for extended alert. It will stay on the credit report for 7 long years.

Consider these points and your identity will less vulnerable to criminals like hacktivists, cyber thieves and spammers. Enjoy safe surfing!

Leave a Reply