Criminals are always gazing to find the weakest link!

The unlocked door, the sleeping guard, the unprotected safe & unsuspecting target of credit card scams.

In today’s crazy information age, your credit card details are pretty much at risk. These frauds costs people hundreds of millions of dollars every year. Though anyone can fall a victim of credit card scams, luckily you can take some effective measures to prevent it.

Best Practices to Bypass Credit Card Scams

With a few simple precautions, you can go a long way keeping your credit card safe and avoid being target of Identity Theft.

- Don’t Give Out Your Credit Card Details Over Phone

You got a call from XXX posing as an employee of Federal Government. He asks you to qualify a program, if you do, they would erase your credit card debt. In return, they just want your credit card information so that they can further process your application for the program.

Ask yourself, why do they need this information? If they’re an authorized person they must have already been in contact with your respective bank. So, never give your personal information over a call even if you think you know who you’re communicating with. Because ultimately, you’ll never realise who’s at the other side of the line.

- Avoid Clicking On Credit Related Pop-Ups

“Do you want to lower your interest rate?”, “Your bank account has been frozen? Validate your account here http://ow.ly/XBrHA to avoid suspension!”.

These Internet pop-ups are deviously designed to manipulate user into downloading malware or viruses onto their system to further steal information & commit crimes. If you’re really concerned about your privacy, simply dodge these kinds of messages, instead contact your bank or financial institution to verify.

- Review Your Monthly Statements

How often do you receive your credit card statement & toss it onto a pile of “to be read later or maybe never?” You should regularly review them, and if anytime you notice an unusual charge you aren’t authorize of, immediately get in touch with your bank to alert them.

Your credit card report is simply a biography of your life, it’s an essential piece of paper which you can use to your advantage if you suspect an identity theft. So, preserve them always!

- Never Store Your Credit Card Information On A Website

Saving your card details on shopping websites is a regular practice. You simply don’t feel like entering the same information again & again. However, you’re unaware that your sensitive information is exposed to a lot of potential threats.

Storing your personal details on websites are simply making thing easy for online criminals to try commit credit card frauds.

Also Read : 5 Cybersecurity Predictions For 2019 You Must Know

- Use An Identity Theft Protection Tool

Taking help of a dedicated security app will only help you stay protected in online world. Without any hassles, you can rely on Identity Theft Protection services that would comprehensively monitor your activity and offer you a secure shield to safeguard your financial details.

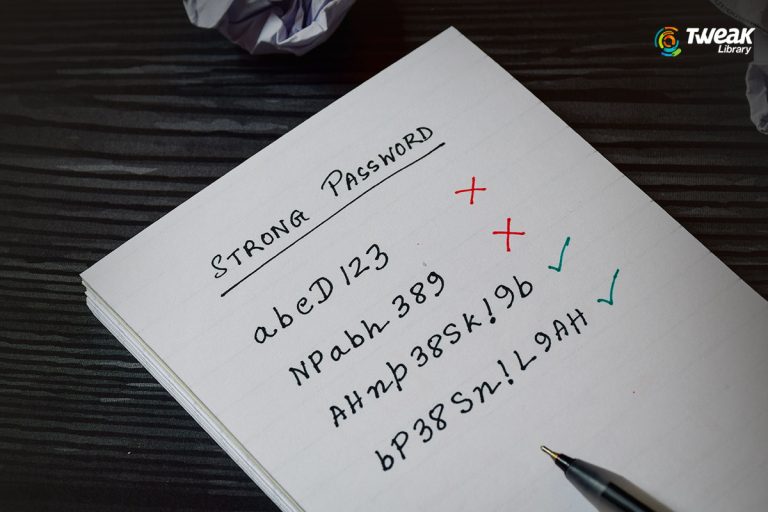

You could use Systweak’s Advanced Identity Protector for the purpose, that would not only protect your sensitive information from online spying but would also organize your personal data in a manner that could only be accessed by you & not anyone else. You can use it’s built in ‘Secure Vault’ for securely storing and managing your passwords.

- Report Identity Theft Immediately

You’ll be amazed to know that how long it takes for people to report identity theft or any fraud. If you believe that your credit card is compromised & your identity has already been used to commit frauds, then immediately contact:

Social Security Fraud Hotline: (800) 269-0271

Internal Revenue Service: (800) 908-4490

And get in touch with your local police station & file a complaint with Federal Trade Commission (FTC)!

Stay Cautious & Prevent Credit Card Frauds With These Quick Tips!

Petty Bliss

I would like to know how to prevent credit card fraud. I just did this for a small project which I think should take a few hours (probably about a month, but I was able to work around the problem when I left my current employer).