Nowadays, everything goes online due to the current COVID19 situation, as personal activities are restricted to a greater extent. The market strategy and customer perspective are changing day-by-day. For using or hosting any service online, customer engagement is the key factor for success. Banking sectors have to switch over to digital tools to succeed in this competitive market.

Going digital can help bankers to overcome the drawback of lack of face-to-face interaction with the customer. Because of the pandemic situation, all banks are working with minimal employees. This may affect the functionality of the depository while using traditional methods. So, it is unavoidable for finance sectors to reconstitute with digital tools like Artificial Intelligence and Data Analytics for streamlined banking operations and successful customer satisfaction.

Role Of Artificial Intelligence In Banking

About AI

Artificial Intelligence is the advanced technology that are used for self-developing and self-learning machines. This technology has contributed massively in last 10 years and counting. AI contributed in the advancement of stock market, banking, aviation, automation, medicines, production and various other sectors.

The need for artificial intelligence is vital and well needed in feature to enhance the living habitation of humans and other living and non-living organisms. AI has enabled science and computers think smartly and make right decisions.

Computer is powered to think smart and make its own decision.

Application Of AI In The Banking Sector

Artificial Intelligence can be useful in different activities of the finance sectors and it can accomplish all the requirements of credit unions effectively. The application of Artificial Intelligence in the banking sector can also reduce cost and time.

AI In Front Office

Preset AI tools can be used to carry out front office works of the bank competently. The front office operations of the depository are involved in customer relationship activities like customer identification, authentication, user-specific recommendations for clients, etc. These endeavors of investment sectors can be skillfully rehearsed with the help of AI tools.

AI In The Middle Office

Middle office activities of the banking sector involve verifying customer transactions, fraud detection, credit score calculations, enhance the process anti-money laundering and you can also keep a track on customer visit frequency with the aid of artificial intelligence.

AI-Enabled Customer Support

AI can be used to enhance the customer experience with the financial service using a conversational AI model and AI-enabled chatbots. This chat support can be operative 24 hours and can provide the most accurate suggestions to the customers with their personal activity data.

Role of Data Analytics in Banking Sector

Data analytics is useful in predicting and analyzing the outcomes of the banking operations performed by the finance sector. It is useful in deciding future activities and responses.

Knowing Your Targeted Audience

With the history of customer activities and their purchased product, the possible potential to a banking sector can be identified with the SAS analytics tool. The database of product to which the customer is attracted and their online behaviors and trends can be recorded to predict the expected customer.

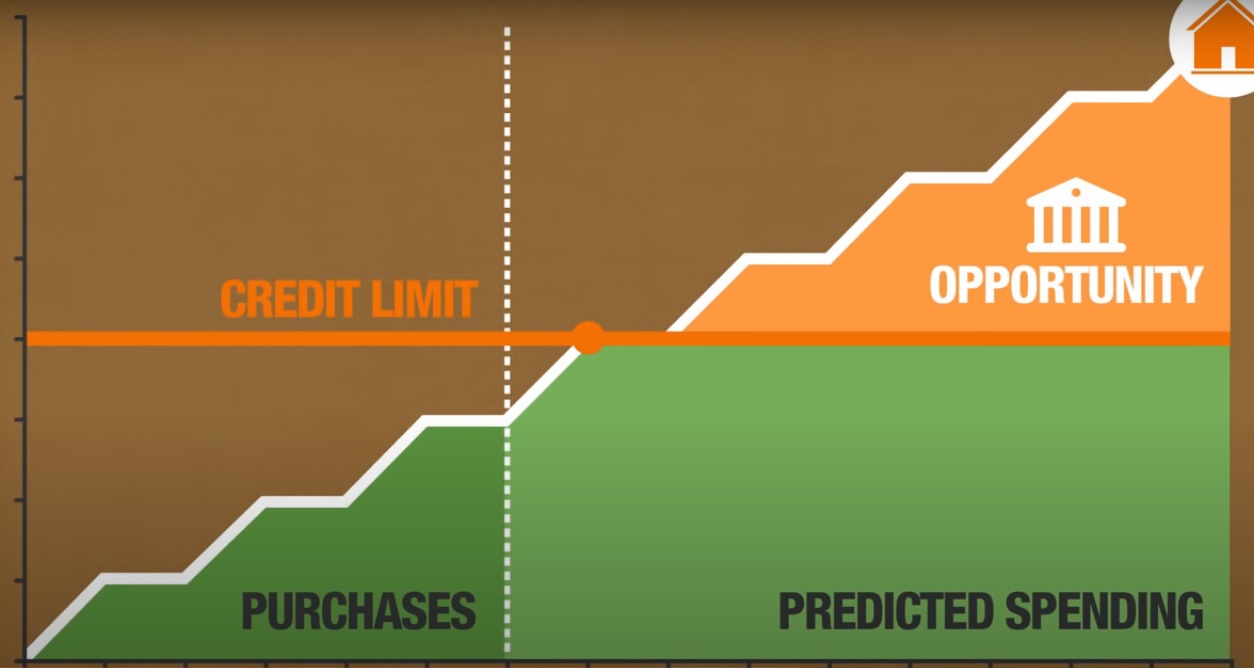

Credit

You can identify the right customer to lend money with the data analytics tool. Also, you can regulate payments, reduce delinquencies, dues, and increase the overall financial profit of the sector.

Interest Rate

Data analytics can be useful in interest calculation, interest rate risks, and maintaining the risk tolerance rate of the bank.

Marketing

Product variety can be regulated and updated with the help of analytics data. Suitable marketing channels for reaching the targeted customer can be identified and the overall sales of the firm can be increased with the analytics.

FAQs

1. How do you use AI in finance?

AI can be useful to analyze all types of accounts, can monitor the performance of the individual clients, identify the financial health of the customers. It can also prepare customized representations for each customer based on the user data.

2. How Blockchain can be used in banking?

Using a decentralized ledger for payments blockchain can be used to enhance the payment speed of the financial firm. Blockchains can also be useful in securing payment activities in your banking sector.

3. How analytics is used in banking?

Data analytics is useful in data mining, and in enhancing the activities of the banking sector It can help you in identifying potential customers and retaining the acquired customers. Also, it enables you to manage the risk factors and to enhance customer involvement. With the SAS analytics tool, you will be able to acquire a potential customer base.

Conclusion

With the advancement of Artificial Intelligence and Data SAS analytics, you will be able to improve the performance of your financial firm enormously. You can work with more accurate and precise data with the help of an analytics tool. Customer engagement which is the key factor for the success of any business can be enhanced to a greater level thereby increasing the profit of the organization.

Next Read:

Will AI Take Over The Socially Distant World?

What is Big Data? Why Big Data Analytics Is Important?

Leave a Reply