Track your investments and spendings with these money management apps.

Now that we all carry a mini computer in our pockets why should we wait to note down our investments and spendings?

There’s an app just for everything from budget management to money management. We can use any of the listed best budget management apps to take care of every aspect of personal finances.

These listed money management apps are perfect for everyone and by using them you can get your money under control.

Best Budget and Money Management Apps

This is where a smart, efficient and effective money management plan would come to play. Using these best budget apps you can perform your daily tasks and keep a check on your expenses.

A good budget and money management app will take all the worries of managing personal finances from life. Moreover, will make you aware of the pain points like excessive credit card use, lack of retirement savings, etc.

But which budget and money management app should you use?

Here we list the best budget and money management apps, each of which have their own strengths, features and benefits. You can choose any of these budgeting apps to manage your money.

With that in mind, we’ve compiled the best money management and budgeting apps:

1. Mint

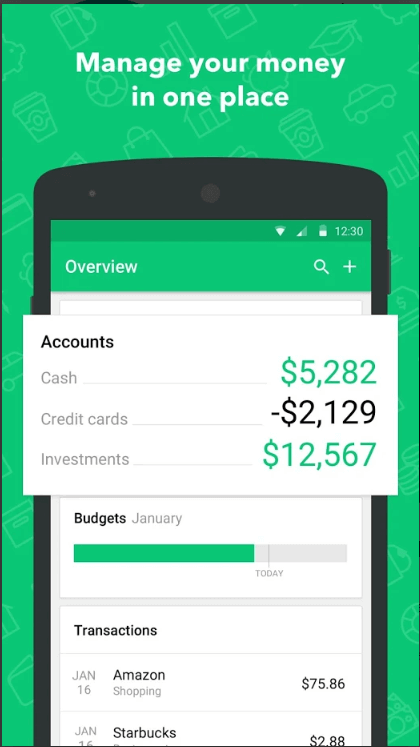

This one is the most well-known money management app. Mint allows users to create budgets, receive reminders, sign in securely using 4-digit code, track bills, receive a free credit score, etc.

What makes Mint outstanding and best money management app is its budgeting feature. Using it you can link your bank, loan and credit card accounts, and see where your money goes. Moreover, this information can be used to get budgeting suggestions based on spending. Mint categorizes this information so that you can know how much you can save by cutting back your spending in a specific category.

The app not only helps manage money, but it even helps find ways to do savings along the way. This best budget app is compatible with multiple platforms, alerts when you go out of budget, and if free to use.

2. YNAB- You Need A Budget

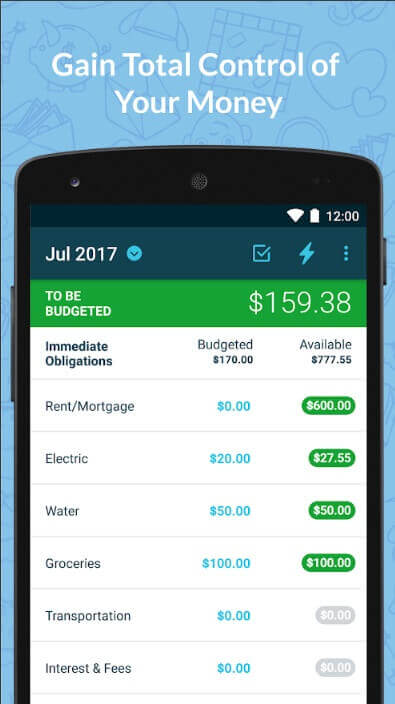

Break the paycheck to paycheck cycle, get out of debt, and manage your money intelligently with YANB – You Need A Budget app. This budgeting app helps set a goal, and manage money so that you can spend it on a vacation, on higher studies, etc. YANB allows bank synching means you can easily connect all your account at one place to manage the funds.

YANB is one of the best budget apps that help user create a personal financial budget that’s income-based, and access data in real time to share with a partner. Using its debt paydown feature you can easily focus on your target and know how close you are getting to paying off your debt. YNAB is free for 34 days, then it costs $6.99.

3. Personal Capital – budgeting, investment and finance app

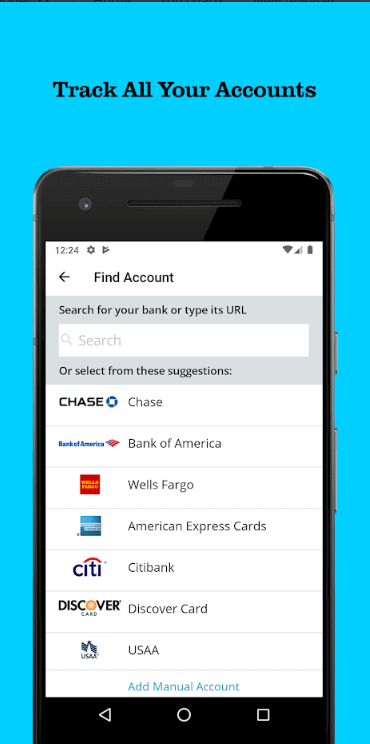

Dig deep into your investments, take control of your financial life with Personal Capital budgeting, investment, money management app. This is one of the best budget apps as it gives you a 360-degree view of your money, using it you can setup and track your budget, keep an eye on investment, plan for retirement, etc.

Personal Capital helps connect your financial accounts i.e. loans, credit cards, savings, etc to easily create a budget , plan, track investment, etc. This money management app is ideal for someone who wants to focus on investments, not spending.

Using Personal Capital budgeting app you can put together a long-term investing plan. Moreover, can use fee analyzer to know if you are getting the most efficient use of your money. This budgeting and money management app is more about planning and the future. It helps build wealth than track the spending. This app is free but those who want to use its advanced features can purchase the premium plan.

4. Albert

Automate your financial life with cutting edge technology offered by Albert. This best budgeting app monitors your balances, bills and spending. Simply enter your goals and get automatic savings done by Albert. Once your accounts are connected with Albert, this money saving app will analyze your income, spending, budget, etc. to decide how much you can save each month and transfers the money automatically to Albert Savings.

5. Mvelopes – Intuitive budgeting app

Achieve financial peace of mind with Mvelopes a simple to use budgeting app that helps take control of the future. Using Mvelopes you can add your financial accounts at one place and manage money to keep yourself going on the path of financial freedom. Unlike YANB, Mvelopes uses an envelope budgeting method to help plan and track your personal or household budget. Moreover, using Mvelopes you receive feedback on where you spend your money and how much you are left with.

Alongside, Mvelopes has partnered with the Center for Financial Services Innovation to provide you with a free Financial Health Score.

6. Clarity Money – best expense tracker

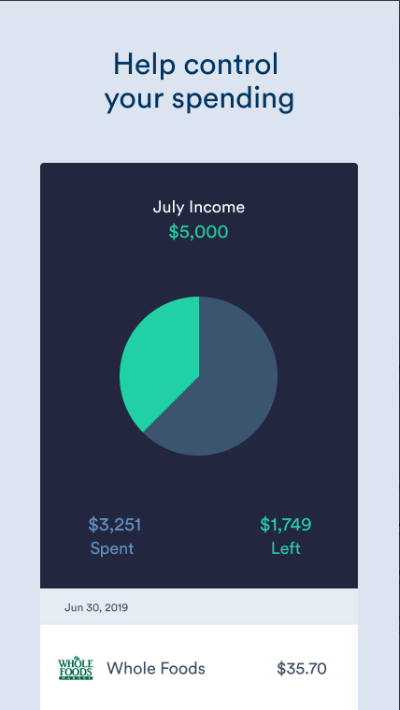

This expense tracker and money saving app offers a wide array of features that will help in money management. Like other best budget apps Clarity too needs you to link your financial accounts. Once the accounts the links Clarity crates a pie chart to show your finances and expense.

Moreover, Clarity even identifies subscription-based expenses, like Netflix, gym memberships, etc. Biggest plus point of this money saving app is that it helps cancel unwanted accounts that make hole in users wallet.

Like Albert, Clarity money management and savings app allows user to transfer and save money.

Note: This app is no longer Available for iOS.

7. Goodbudget – best money saving app

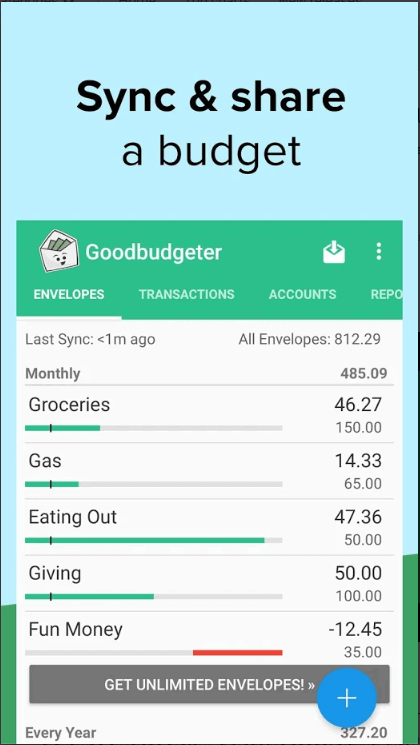

As the name suggests, this one is the best budget app as it helps manage monthly budget by keeping the salary into different envelopes. Goodbudget works like Mvelopes allowing you to take out money for each expense. This budget planner app helps stay on top of bills and finances.

Goodbudget syncs transactions with cloud making them accessible from other devices. Moreover, using Goodbudget money saving app you can stay on the same page with your loved ones about finances. This expense tracker app even provides insightful reports to make sense of your budgeting and spending. Moreover, you can sync up to 5 devices and can keep 7 years of transaction history in Goodbudget.

8. PocketGuard – personal finance manager

PocketGuard studies your debts and bills to recommend strategies that will help cut down the debts. This money saving app does a better job when it comes to tracking expenses. PocketGuard sees exactly how much is in your pocket, compares spending month by month, creates spending limits and shows notifications with balance goes low.

Moreover, PocketGuard expense tracker app even lets you sync your loans, savings, and investment data. The app is visually appealing, and it shows an alert when a bank fee or any unwanted charge hits the accounts. Moreover, PocketGuard money management app is 256-bit SSL encrypted to protect all your sensitive data.

9. Every Dollar

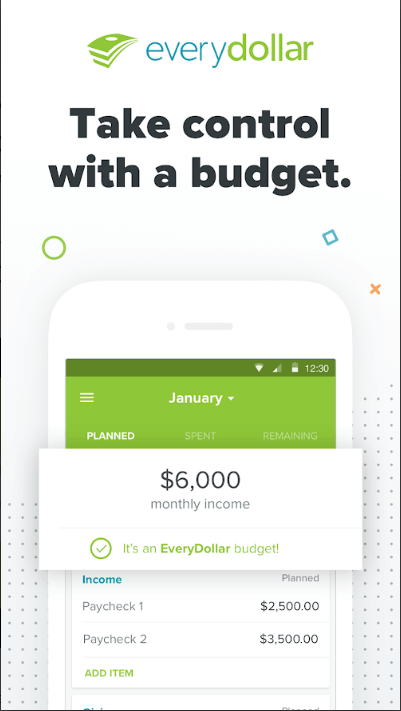

Take baby steps towards managing your money and saving the maximum. This best budget app follows the zero-based budget approach recommended by financial guru Dave Ramsey. EveryDollar creates a fully customizable daily and month budget in minutes. Using EveryDollar money management app you can access your budget planner via app or desktop browser. Moreover, EveryDollar lets you track spending as and when it happens, split expenses, etc. Using this money saving app you can adjust or reset your budget, set reminder to keep track of your transactions and spending.

10. Wally

Take control of your money with Wally. This money management app is great if you are looking for a simple solution to seamlessly save money. Using this expense tracker app you can connect all your bank accounts, or can manually track your cash, savings, loan accounts, etc. Not only this Wally best budget app even lets you plan upcoming payments, manage all your foreign currency, get insights on your spending, understand and project cash flow, set weekly reminder, manage joint account and share spending. The app is a good budget management and is free of charge.

This was a comprehensive list of best budget apps that are good expense tracker and great when it comes to money management. You can simply pick any of the app according to your requirement and get your money savings on the tracks.

Do let us know which app your picked from the list and why in the comments section.

Leave a Reply