What Is A Chargeback?

In layman terms, chargebacks are disputed transactions. The term typically refers to a service offered by your debit, prepaid or credit card provider to get you a refund if something wrong happens during your purchase through the card.

A chargeback happens when a consumer asks the bank to forcibly take money out from the merchant’s account, rather than contacting the business directly for a refund.

But being a Consumer, you don’t have an automatic right to demand a chargeback. There should be a valid reason to ask for a chargeback.

Reasons For Chargebacks

You can initiate a Chargeback only in the following situations:

- You did not authorize a transaction.

- Never received the merchandise or service you paid for online.

- Received damaged or counterfeit products.

- You’ve been charged a recurring fee even after you’ve canceled a subscription.

- You’ve been charged twice for the same product/service.

- You were charged more than agreed for a purchase.

- You were charged in a different currency.

- Didn’t receive a credit for a return as promised.

- Your card is used fraudulently.

Usually, a consumer has up to 120 days to initiate a chargeback, but the duration can vary depending on the type of chargeback. It’s recommended to not take too long to claim a chargeback.

Read Also: How Digital Payments Have Impacted Our Financial Transactions?

Difference Between Chargeback And A Refund

Several people use Chargeback and Refund interchangeably, but both terms have a difference.

Chargeback: Initiated by a consumer & can result in a return of refunds (only if the reason is valid). Processed by the bank to help you get your money back, also tarnish the merchant’s reputation and credit score.

Refund: Initiated by the merchant & allows to return the whole or a part of the specific transaction amount.

Chargeback: Process

The exact process for starting a chargeback differs from a credit card company to a company. But before you start the chargeback process, we recommend contacting the merchant first to rectify the problem. It’s actually a business’s interest to fix your problem, then the credit card company to get involved. In fact, it’s cheaper for them to just refund you than having to pay a sizable free, in the scenario, you win a chargeback process.

But in case, merchant refuses to pay the refund, go ahead filing a chargeback against the business:

Note: Ensure you have a valid reason before you for claiming a chargeback. Bear in mind, Bank can close your account, if found that you’re abusing the chargeback scheme for your own good.

Step 1 – Contact your provider (via call or visiting the branch). Ask them about the Chargeback scheme and make a claim for the same.

Step 2- Let them know the complete details about the transaction you want a refund for.

Step 3- If needed, you can provide copies of the correspondence you had while trying to get a refund from the merchant. This can include emails, phone call records, messages, etc.

Step 4- Some banks may ask you to fill and submit a claim form, while some just work on the details and copies to start the chargeback claim against the merchant.

In case your bank is unaware of Chargeback Scheme or you are not satisfied with your bank’s grievance redressal process. You can approach the RBI Banking Lokpal with your complaint. The scheme aims to facilitate the satisfaction or settlements of complaints related to digital transactions. In case, your bank is not taking proper action against the merchant, you can approach RBI Banking Lokpal against the bank.

Read Also: What Can We Do If We Fall Prey To An Unauthorized Transaction?

Note: There are a few important points to remember before you go to Rajasthan Bank Lokpal:

- You must have reported the issue in writing with the concerned bank.

- You must wait for at least 30 days after filing a written complaint with the bank before you approach Banking Lokpal.

- Must have a complaint number issued by the bank, proofs to claim the fraud, etc.

Here’s the list of All The Operative Centers, Name & Address of the office of Banking Ombudsman!

To Lodge Online Complain With Banking Lokpal Rajasthan, Follow The Steps Below:

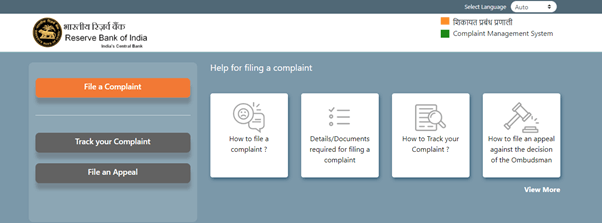

Step 1- Go to the Online Bank Complaint With Banking Lokpal Portal.

Step 2- Click on File a Complaint Link > Select Language from the drop-down list.

Step 3- Click on Type of Entity dropdown button & select the entity against which you wish to file a complaint. In this case, select: Bank

Step 4- Click on the Mobile number of the complainant field & enter the applicable number > Area of operation of BO (Banking Ombudsmen), select applicable option. For example Jaipur.

Step 5- Click on Bank Name > hit No button > Branch Name, fill the applicable option.

Step 6 – Fill the Name, Email ID of the complainant. Click the Next button!

Step 7 – Under Is Complaint Subjudice/Under arbitration? Option, select No.

Step 8- Under Have you made a written/electronic Complaint to the Bank? Option, select Yes.

Step 9 – Next, you have to click on the Calendar icon, located in the Date of Complaint section. Set the Date of Complaint registered with the bank and proceed.

Step 10- Set the Complaint category in this step. For example ATM/Debit Card

Step 11- Choose an option No, if your Bank hasn’t responded to your complaint > Next.

Step 12- Set Gender, Age & Complainant Category. For example Individual

Step 13- Fill your Address > Next > Click on Calendar icon again & set the Date of Disputed transaction.

Step 14- Click option Yes, if your complaint is regarding Wallet, else click No.

Step 15- Choose an option Yes, if the complaint is against Business Correspondent > Next.

Step 16- Under Account Category, choose the applicable options. Ex: Cards. Under the sub-account category, choose Credit Card, for example.

Step 17- Enter the applicable card number in the next box > click on the Next button.

Step 18- Hit the Relief sought field and enter the applicable amount. Under the Compensation sought field, enter the applicable amount.

Step 19 – In the next field, Facts of the complaint, describe your case. Click Next!

Step 20 – Read the Declaration and proceed with the Next button.

You can even declare any Nomination. Give the appropriate Name, Email ID, Address, State, District, City, Pin code & click Next button.

Step 21- Enter the applicable code and click the Next button. Attach files to your complaint.

Just note your complaint number and download the PDF for the same. This would help you further to claim your chargeback. The Banking Ombudsman (BO) will investigate the case & would make the settlement via conciliation between the bank & the consumer. This requires at least 30 days. But the option to approach Consumer Court always remains open.

You can watch this video as well to apply the steps mentioned above for filing a complaint against your Bank at Banking Lokpal!

Leave a Reply